IR Waterfall

Overview

Verification of Employment and Income (VOE/I) is required and crucial in a borrower’s ability to obtain a loan. However, securing a VOE/I typically requires time-consuming manual processes and often comes at a high price. Mortgage professionals needed a solution that simplified the verification process, reduced expenses, and enhanced their overall efficiency.

Floify partnered with Informative Research (IR), a leading technology platform that delivers data-driven solutions, to introduce their Waterfall feature into our platform.

The Waterfall feature automates the VOE/I process by running verifications with multiple vendors until a successful result is achieved. The collaboration aimed to revolutionize the way mortgage professionals handled verifications, providing a more cost-effective and efficient solution.

Role

As the Product Designer for this feature, I concentrated on developing a smooth experience for both Floify’s company users and mortgage professionals engaged in the VOE/I process. This involved conducting market research, collaborating on design concepts with an external partner, and refining designs through project demos and usability testing. Working closely with IR’s Integrations Analyst, we ensured the seamless integration of the Waterfall feature into Floify’s platform.

Methods Used

Cross-Functional Collaboration, Feature Prioritization, Task Flows, Usability Testing, Wireframing, Prototyping

Tools

Figma, Jira, Slack, Zoom

Timeline

January 2023 — July 2023

Problem Space

The mortgage industry faces inefficiencies in VOE/I processes, with significant challenges coming from manual workflows and high prices. Relying on manual verification processes results in bottlenecks; delays in processing times, increased error probabilities, and constraints on handling a growing volume of verification requests. Our objective was to implement an automated selections of vendors for Floify users through the IR Waterfall integration, with the aim of identifying cost-saving opportunities and reducing the risk of errors associated with manual handling.

Opportunities

The introduction of IR’s Waterfall integration presented a significant business opportunity for Floify by addressing some of our lenders’ key challenges. The solution would not only reduce costs and improve efficiency, but it also positioned Floify as a platform that adapts to market changes and is apt for cultivating strategic partnerships. Our central focus revolved around the following opportunities:

Cost Reduction

The IR Waterfall feature automates vendor selection, starting with the least expensive option and progressing until a successful verification is obtained.

Time Saving

The IR Waterfall feature accelerates the verification process, contributing to a faster application-to-close timeline.

Integrated Platform

Floify's collaboration with IR allows users to perform the entire VOE/I process within Floify’s platform. This integrated approach eliminates the need to switch between two systems.

Market Responsiveness

Mortgage professionals can now address the challenge of rising verification-related fees by utilizing a cost-effective and automated solution.

Risk Mitigation

The automated process ensures consistency and precision in running verifications, mitigating the risk of manual-related discrepancies.

Challenges

Below are the constraints that shaped the trajectory of the IR Waterfall integration and the factors that defined the project’s boundaries, limitations, and guiding parameters:

Partner Collaboration and Dependencies

Collaborative efforts and dependencies on IR for updates, support, and issue resolution. Timely responses and coordination were key; any delays in feedback or inquiries had the potential to impact our deadline.

Cross-Platform Consistency

Achieving uniformity in design elements and user experience between our two platforms posed a considerable challenge. This required us to develop new design components within our existing legacy system to harmonize with IR’s UI. The interface objective was to ensure a consistent and familiar user experience between both platforms. This involved meticulous attention to detail, adaptation of design elements, and close collaboration while still maintaining Floify’s brand consistency.

Limited Testing for Product

Having limited access to the testing environment for the Product team imposed constraints on my ability to thoroughly evaluate the integration. The shortage of testing opportunities created challenges in simulating various use cases and identifying nuanced issues that might arise.

Research

I explored several critical topics for this project, resulting in valuable insights and a deeper understanding of our users' needs and project requirements. Some of the topics I investigated and shared with my team to shape the project were:

Industry Pain Points

Conducted an in-depth analysis to identify pain points associated with time-consuming processes, potential errors in manual handling, and challenges in vendor selection.

User Needs and Expectations

Engaged in user interviews with enterprise clients to gain valuable insights into their specific needs and expectations.

Explored preferences for an automated solution, aiming to streamline the verification process in Floify.

User Testing and Feedback Loops

Conducted user testing with prototypes and demos to gather feedback from enterprise clients.

Implemented refinements based on client insights and suggestions, ensuring alignment with user expectations.

Vendor Collaboration Feedback

Maintained open channels of communication with IR to collect feedback on the collaborative aspects of the feature.

Addressed any feedback or suggestions provided by IR for continuous improvement.

Performance Metrics

Monitored key performance metrics, such as processing times, successful verifications, and cost savings, to evaluate the overall effectiveness of IR’s Waterfall feature.

Delivery

Utilizing the IR Waterfall integration within Floify, lenders now have the flexibility to choose from a curated list of connected verification partners, utilizing an automated process that navigates through each provider in the lender's specified order until it successfully obtains employment data for their borrower.

Leveraging Floify’s Data

Leveraging data from the 1003 form within Floify, the user's information automatically populates into the respective fields. This automation eliminates the need for manual data entry, enhancing efficiency and reducing the likelihood of errors in the information transfer process. Users can trust that the details from the 1003 form are accurately and promptly transferred, streamlining their workflow and contributing to a more user-friendly experience.

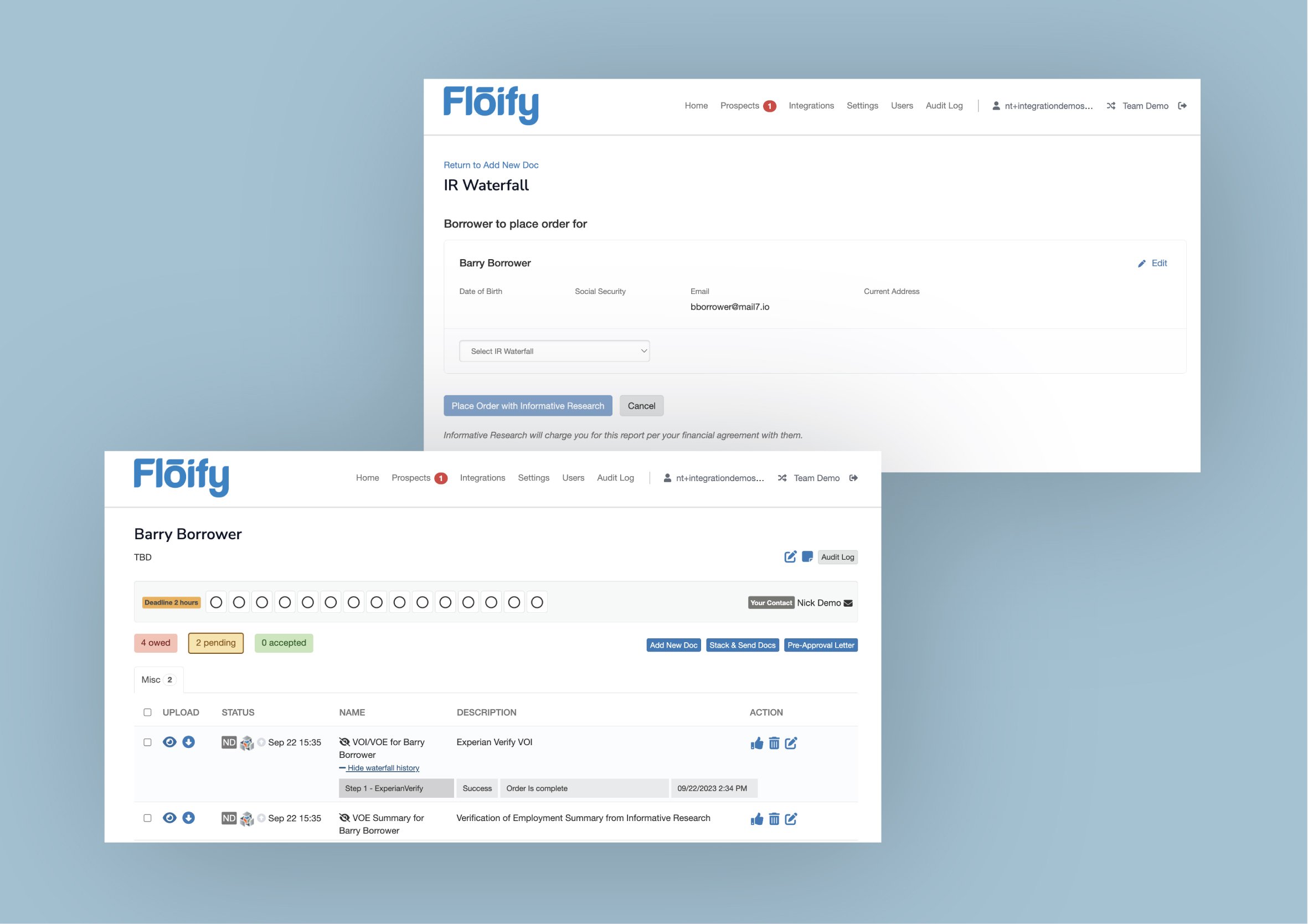

Initiating Waterfall

To initiate the verification process with IR, Floify users would simply click the "Place Order with Informative Research" button. This action triggers the system to communicate with IR, prompting the automated verification process to begin. The selected Waterfall workflow, based on the user’s account settings in the IR system, is seamlessly executed, ensuring a smooth and efficient experience.

Verification Reports

Utilizing Floify's capabilities, users can explore the Waterfall history to accurately pinpoint the successful verification provider. This functionality provides a clear and detailed overview of the verification process. Floify’s users can also download their borrower’s comprehensive verification report(s) which include essential details like employment verification, income records, and W2s. By providing these insights, Floify ensures an efficient workflow for users in the loan application process, facilitating a thorough evaluation of their borrower's employment history.

Post Release

Time Savings

IR Waterfall reduces the verification process time from an average of 45 minutes (manual completion) to an average of 30 seconds in Floify. (Data obtained by performance metrics)

Percentage reduction in time spent on verification tasks: 98.89%. (Data obtained by performance metrics)

Cost Reduction

Up to 70% savings on reports (Data obtained by Informative Research)

Fill Rates and Data Accuracy

90%+ fill rate and data accuracy (Data obtained by Truv, a verification provider of Informative Research)

Efficiency Improvements:

Multiple verifications processed per hour with IR Waterfall compared to an average 2 verifications per hour through manual processing. (Data obtained by performance metrics)

Results & Takeaways

The IR Waterfall integration was my first significant project at Floify, and it remains the one I am most proud of. Dealing with tight deadlines while collaborating with an integration partner was challenging at times. On multiple occasions, I encountered situations where important information was missing and I had to be persistent to ensure our project’s success. I learned how assertiveness and persistence play important roles when designing a project under tight deadlines. That, coupled with being adaptable made this project an excellent growing opportunity for me as a product designer.