Pre-Approval Letters

Overview

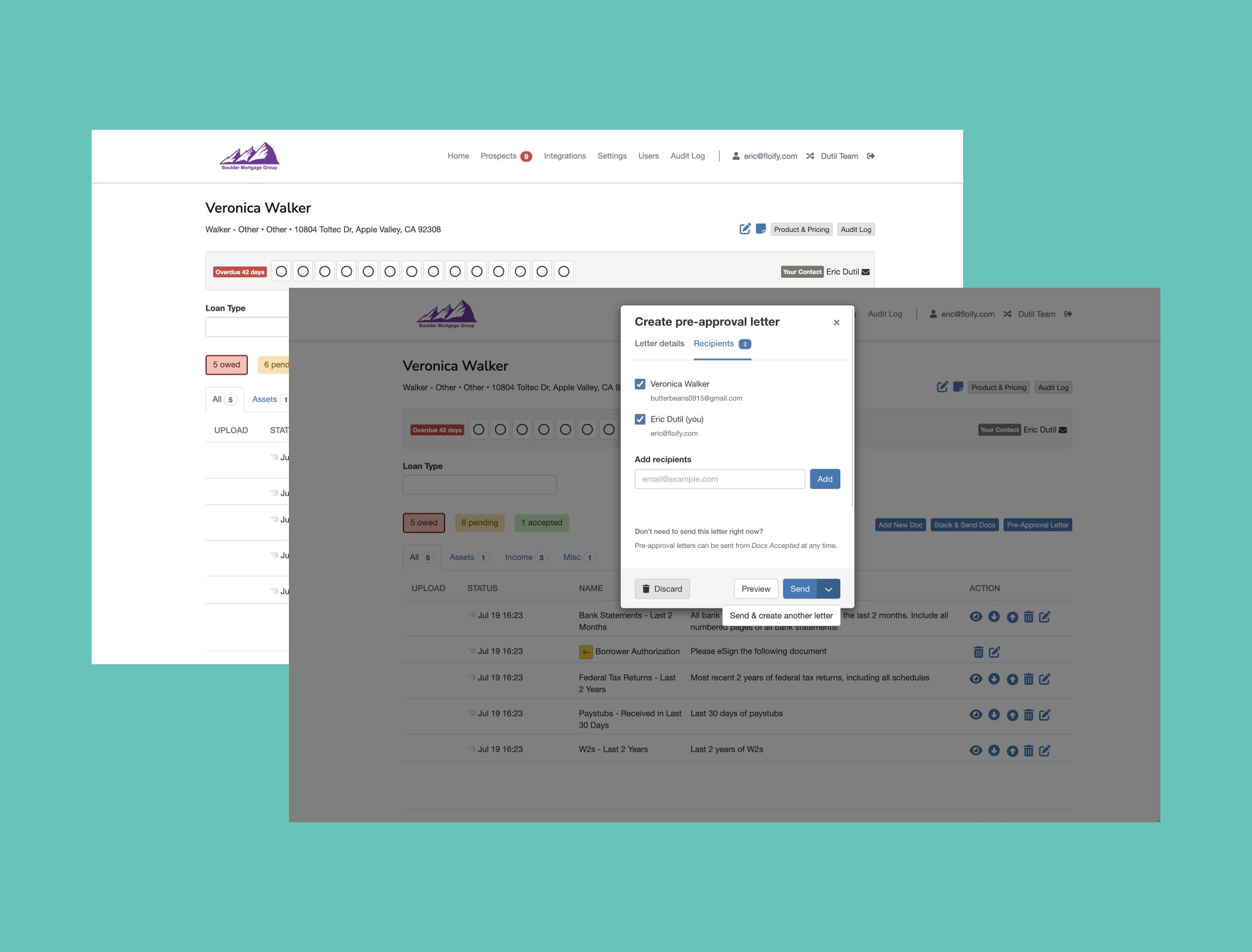

In the enhanced Pre-Approval Letter feature, we've modernized the pre-approval letter process for a more intuitive experience within the loan pipeline. Unlike the previous version, users can now set parameters directly through the loan pipeline, guided by clear instructions for easy configuration. We added the ability to manage recipients, enabling users to add, remove, and oversee recipients who receive the pre-approval letter. We also introduced the "send and create another letter" feature, providing users with the choice to either generate and send a single letter or opt for the flexibility of creating multiple letters and deciding when to send them. We incorporated intelligent warning messages by highlighting any missing fields in the Letter Details section.

This enhancement not only simplified the PAL process but also elevated efficiency and user-friendliness, providing users with the necessary tools for seamless navigation and effective communication with their borrowers and partners.

Role

As one of two Product Designers for this feature enhancement, my role involved envisioning and implementing improvements for the enhanced Pre-Approval Letter feature. I actively engaged with users through outreach initiatives, including user interviews and feedback sessions. By gathering insights directly from users, I was able to identify the existing pre-approval letter processes pain points and user preferences. I collaborated closely with our senior designer and sales team, leveraging data from diverse perspectives as well as our Delighted Survey to further understand our user’s pain points and expectations. Our lead designer and I focused on enhancing user interactions, ensuring clarity in parameter setup, and introducing features like recipient management and the "send and create another letter" option for a more efficient experience. Throughout the project, we aimed to elevate the overall usability and visual appeal, contributing to the successful implementation of this feature enhancement.

Methods Used

User Interviews, Surveys, Data Analysis, Cross-Functional Collaboration, Feature Prioritization, Usability Testing, Wireframing, Prototyping

Tools

Figma, Jira, Delighted, Pendo, Slack, Zoom

Timeline

June 2023 — August 2023

Challenges

The decision to enhance the pre-approval letter process stemmed from a keen awareness of user challenges and feedback. Users expressed frustration with the time-consuming nature of leaving the loan flow to set up parameters, and the lack of control over recipients caused complications in various borrower scenarios. Additionally, feedback from interviews and surveys highlighted the need for a more efficient way to generate multiple pre-approval letters for a single address, a common requirement in real estate transactions. Furthermore, the old process's error handling presented significant user inconvenience. Understanding these pain points, the decision was made to revamp the process, introducing features like parameter setup within the loan flow, recipient management, a streamlined "send and create another" option, and improved error handling to significantly enhance the user experience and streamline the pre-approval letter workflow.

Opportunities

The enhanced pre-approval letter process presented various opportunities to improve user experience and operational efficiency such as:

Mitigating Missed Opportunities:

By accelerating the pre-approval letter generation process, it significantly reduces the risk of losing opportunities for sought-after properties. This not only gives borrowers a competitive edge but also enhances their chances of successfully securing their desired home.

Recipient Management:

The enhanced process streamlines the inclusion of both the primary borrower and other relevant parties on the pre-approval letter. This simplification improves the representation of financial responsibility and ownership.

Generating Multiple Pre-Approval Letters:

LOs and realtors can take advantage of the opportunity to generate several pre-approval letters based on seller preferences. Generating more than one letter allows for customization, aligning with specific seller requirements and increasing the chances of a favorable response.

Fostering Positive Relationships:

The streamlined pre-approval letter process creates positive relationships between borrowers and their real estate agents and/or lenders. By enhancing efficiency, this establishes strengthened connections that are likely to encourage borrowers to return to their agents/lenders in the future.

Constraints

The had very few constraints for this enhancement, as the need for an overhaul was apparent through data analysis. This clarity streamlined the development process, making it a straightforward and efficient enhancement. Nonetheless, two constrains emerged:

Project Deadline:

In order to meet our 3 month deadline we meticulously planned the project and efficiently allocated resources, ensuring the timely delivery of a high-quality, user-friendly enhancement.

Learning Curves For Our Users:

Navigating the improved process had the potential to present challenges for users accustomed to the previous feature. To ease this transition, we implemented in-app guides through Pendo for effective onboarding.

Research

Through user interviews, testing, and surveys, we found that users were struggling with several pain points and challenges in the existing pre-approval letter generation process. Our research initiatives aimed at addressing these issues and enhancing the user experience.

Existing Feature’s Pain Points

The initial parameter setup proved to be time-consuming, requiring users to navigate back and forth between settings and the pre-approval page.

Users expressed the need to send the pre-approval letter to individuals beyond just the primary borrower, such as co-borrowers or co-signers. This ensures that the pre-approval information is accessible to all parties participating in the transaction.

Users encountered challenges with inaccurate address details, resulting in errors during the letter generation process. Notably, users would discover these errors only after saving and exiting the modal.

Lenders and real estate agents frequently encounter scenarios where the need arises to create multiple pre-approval letters for a single address. The primary motivation behind this requirement is to tailor the pre-approval letters to align with the specific individuals or entities associated with the property transaction.

User Needs and Expectations

The need for a more efficient and time-saving process in generating pre-approval letters.

Flexibility in adjusting parameters, such as property address, sales price, down payment, and closing costs.

Comprehensive representation of the financial structure and ownership arrangements involved in the transaction.

The ability to create multiple pre-approval letters for a single address.

The ability to preview the pre-approval letter before sending.

Delivery

The improved pre-approval letter feature has received positive feedback from users, signifying significant enhancements in usability and functionality. The simplified interface streamlines the process of setting up parameters and managing recipients efficiently. Users appreciate the flexibility to preview pre-approval letters, ensuring accuracy and completeness before finalizing them. The added capability to generate multiple pre-approval letters and schedule sending them later is well-received. The system's clear interface and customizable options collectively contribute to an overall enhanced user experience.

Enter Pre-Approval Letter Details

Once users have established the necessary parameters, the Pre-Approval Letter interface becomes accessible, allowing them to navigate through and utilize its features. In this interface, users will find fields where they can input specific details such as Property Address, Sales Price, Down Payment, and Actual Seller Paid Closing Costs. It's crucial for users to tailor this information exactly as they'd like it to appear on their pre-approval letter.

To initiate this process, the parameters must be configured initially. If, for any reason, these parameters have not been set up, the system will guide users through a prompt within the interface, urging them to add the required details.

Enter Recipients

Users can set recipients for the process. By default, the borrower and realtor will automatically be selected but users have the option to expand the recipient list further by entering another person's email address and then clicking the "Add" button. Alternatively, users can choose not to send the letter to any recipients if they wish.

This level of control ensures that users can adapt and customize the recipient list according to the evolving needs of a rapidly changing real estate market.

Preview

At any stage of the process, users can choose to preview the letter, taking into account the current parameters that have been entered. This preview option allows for a thorough examination of the document's content and formatting before making any final decisions. After the preview, users have the flexibility to either proceed with sending the letter as is or return to the editing interface to make any necessary adjustments.

Send and Create Another Letter

Users are presented with two distinct options for sending the pre-approval letter. The first option allows them to send the letter individually, completing the process. The second option streamlines the workflow by allowing users to send the current letter while simultaneously initiating the creation of another.

After deciding how to send out the letter, users can expect to receive a the successful confirmation of the letter’s transmission.

Results & Takeaways

Throughout the course of this project, I've gained valuable insights into user preferences and expectations, highlighting the significance of a user-friendly interface in software design. The positive user response to the enhanced pre-approval letter feature underscores the importance of talking to users and completing surveys to get an idea of what they need. For this feature we learned that flexibility was the main factor, with users expressing a strong preference for the ability to preview, adjust, and generate multiple pre-approval letters, offering them greater control over the process.

These collective insights highlight that user satisfaction is influenced by various factors, including user-friendly design, functional flexibility, efficiency improvements, customization, and integration capabilities. These lessons learned will play a crucial role in shaping future projects, guiding the development of software solutions that prioritize user-centric design and operational efficiency.